Industry Research: Why the EV Charger Market is Consolidating

We offer custom industry research & competitive intelligence solutions. Below is a sampling of the types of data and insights we’re able to source, analyze, and deliver to clients.

Within the last month, two major car brands - Ford and shortly after GM - and electric vehicle startup Rivian have announced partnerships with Tesla to modify their charger ports for future vehicles and gain access to Tesla’s EV charger network.

Leveraging a competitor’s product is unusual in most industries. Here, though, the partnerships make strong sense for a number of reasons:

The market isn’t big enough to support multiple charger networks

The customer experience will be improved with a common standard

The charger is just a component - not the primary value - of an electric vehicle

In this research, we leverage data and analytics to lay out our case for why this decision was made, why Tesla was the industry winner, and how the decisions benefit the industry as a whole.

A Data-Driven Market Analysis

To understand the decision to partner with Tesla, it’s important to first understand the market in which these brands compete.

The electric vehicle market is small but growing. It has moved from early adopters to mainstream hype but still relatively low adoption.

Electric and hybrid vehicle sales are just ~13% of the market but are gaining traction fast through subsidies, regulations, and increased availability.

Because electric vehicles operate on a wholly different infrastructure than gas-powered vehicles, there’s a bit of a “chicken and the egg” problem at play:

The industry can’t take off without widespread charging availability, and to invest the significant capital into creating charging infrastructure requires mass market adoption to achieve reasonable returns.

Commercial chargers will only be developed when the market opportunity (and/or supporting subsidies) make it economically feasible.

With this premise in mind, we’ve developed two theses for why consolidation is happening in the industry:

The charger isn’t a strategic battle worth fighting

The market economics for multiple chargers doesn’t add up

The Charger Isn’t a Strategic Battle Worth Fighting

The charger is a component - not a core selling point - of an electric vehicle. Decisions are made on battery range, car design, size preferences, and more. Charging speed matters, but the charger itself is an enabler not a differentiator.

Companies regularly outsource components of their product that don’t make sense to own internally. Apple doesn’t develop every app in its app store. Netflix doesn’t produce every piece of content on its platform.

Imagine if there were multiple “liquids” to power a car today (materially different, not different grades of oil). Gas stations would be fragmented - some selling one type and some another. Access would be limited based on who drove which types of cars in an area.

The industry wouldn’t operate as seamlessly as it does. One standard of power (gas) was the only way to drive adoption and convenience at scale for vehicles.

Chargers are the new gas. The means of power are less important than making the component standardized, accessible, and convenient. It benefits the whole industry and a rising tide lifts all boats.

For wide scale adoption - both the supply side and demand side - all customers need to be on the same energy standard.

Ford and GM are a 10+ years behind Tesla when it comes to developing EVs. The market share reflects this. Fighting an uphill battle to develop a second charging standard simply doesn’t make sense.

There will be more than one winner in the EV industry and it won’t come from the charging port

The Market Economics for Multiple Chargers Doesn’t Add Up

The more electric cars that are on the road, the more investment there will be in charging infrastructure. The more cars that can benefit from a single charging port, the more valuable those ports become.

Let’s piece together some back of the envelope calculations on market opportunity.

There were ~13.7M light vehicle sales in 2022 in the US and 12.3% had some electric component (hybrid, plug-in hybrid, fully-electric).

This suggests there were ~1.2M cars bought in 2022 that would benefit from a non-Tesla charger (likely less in practicality as non plug-in hybrids wouldn’t use the network).

Electric costs vary by state, but at 12,000 miles driven per year, the cost to charge an electric vehicle comes in somewhere in the neighborhood of $360-$600 based on cost estimates per mile driven.

Assuming that 100% of charging took place at out-of-home commercial stations and a markup of 3-4x for a commercial charger compared to home charging, this comes out to about ~$2B in market opportunity added in 2022 for non-Tesla electric vehicles.

Let’s claw back that estimate a bit with more realistic assumptions.

A J.D. Power survey in 2021 found that 88% of EV owners charge at home “often” or “always”.

Our analysis of active stations shows 18% of chargers are offered free of charge (some with restrictions like a parking fee)

If we generously assume that 50% of total charging takes place out of home, that market estimate drops to $1B in incremental value in 2022.

Based on a range of estimates, there’s probably somewhere in the neighborhood of 2.5-3M electric cars on the road today (including Tesla). This equates to a market opportunity of ~$2-2.5B at 50% away-from-home charging. This is not very big.

The market is fast-growing, but it’s an asset intensive industry to stand up.

The cost and time to acquire and install the chargers, create the partnerships for access to the land (i.e. Tesla partnering with Target to install chargers in their parking lots), and service the ongoing maintenance leaves little profit margin.

The ability for consumers to charge at home distorts the value of commercial charging infrastructure compared to standard gas charging.

No matter how you look at it, the economics don’t add up to invest in charging infrastructure that doesn’t benefit all electric vehicles on the road.

Tesla’s Value in the Existing Charger Network

Tesla has nearly a decade head start over EV competitors and was early - and more strategic - in developing EV charging infrastructure. They had to be - no other car maker was as invested in electric vehicles

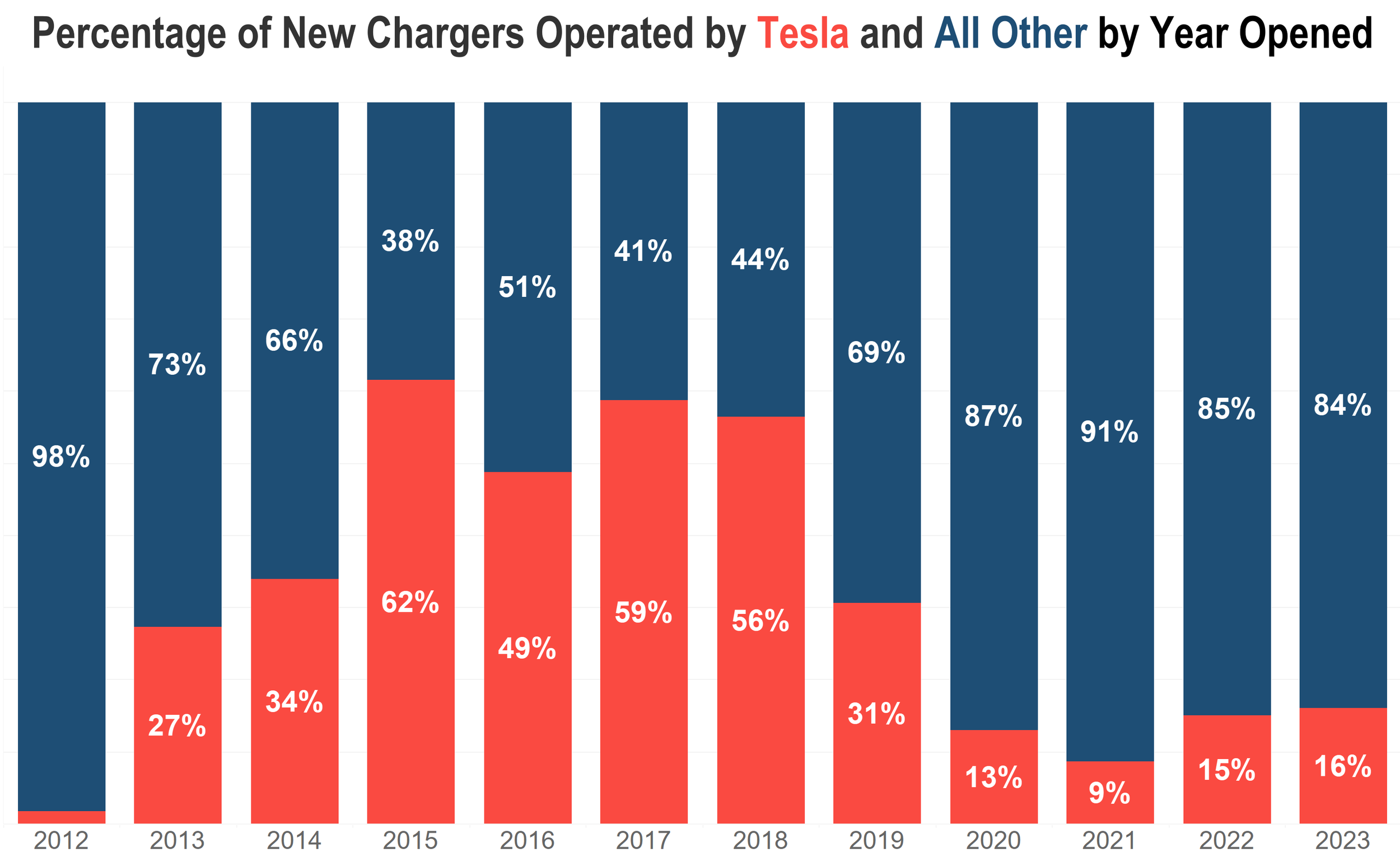

Over the past 10 years, Tesla was opening as many as 60% of the new chargers coming to market. Only over the past few years has that number declined as electric vehicles become more ubiquitous across other mainstream brands.

Source: Analysis of Dept. of Energy Alternative Fuel Station data

Tesla is joined by one other major (non-automotive) brand - ChargePoint - in the race to build charging infrastructure. These two operators comprise ~67% of charging locations and ~63% of available chargers.

Tesla’s value isn’t that it’s the only operator, it’s in the strategic placement of its stations.

Tesla puts charging stations where competitors haven’t in order to reduce range anxiety and create an interconnected network of stations.

Other networks have built density around people and EV purchases (e.g., in major cities). This strategy makes sense - build where the customers are. Tesla built to connect.

Below is just one example.

There are not many electric vehicles in South Dakota and as such, the infrastructure is less built out. Without Tesla, you could have a stretch of highway ~200 miles long without a charger. With Tesla chargers, this range reduces to 70 miles.

Not only that, but the locations are extremely convenient to the highway. Other chargers would require someone to drive upwards of 50-miles off the highway to access a charger - a completely unfeasible distance.

Zooming out, the top 10 states where Tesla has the highest share of EV charging ports are generally more rural, lower population states.

Source: Analysis of Dept. of Energy alternative fuel station data

Tesla delivers value in dense urban areas, but their real value to the charging network is in reducing range anxiety, connecting the country with ports, and delivering more reliable charging infrastructure.

Final Thoughts: The Strategic Value of a Tesla Charger Partnership

Tesla’s charging stations are better and more reliable than competitors.

According to a J.D. Power survey, 21% of EV owners attempting to charge at a public charging station weren’t able to do so in early 2023. With Tesla, that number is 4%.

Built from the ground-up as an electric vehicle company, Tesla is the best in the business at the infrastructure to support the EV industry.

Ford, GM, and Rivian get to offer its customers more - and better - charging ports. Tesla cements itself as the leader in the EV industry and gets access to billions of dollars in federal funding for openings its network to others.

The industry and consumers benefit from a shift to centralized charging hardware to further build out the infrastructure to be commonly shared by EV owners, just as gasoline is shared by traditional cars.

There is loss for the brands in ceding to a rival, no doubt - imagine Google ceding the phone OS to Apple - but it was a losing battle. The market economics didn’t make sense to run a second parallel network at scale (and the second network now will further deteriorate without Ford & GM).

Consider this - even if our market estimates are completely wrong by a factor of 3x, the market is still only ~$6-$7.5B and has many years to reach maturity. In the absence of subsidies or incentives, few businesses will invest the capital needed to build out the second network at scale.

The charging point is not a differentiator for Ford & GM. Their brand and vehicle value sits in their design, battery range, price, and marketing. Moving to the new standard elevates a rival, but also elevates the industry as a whole, bringing up all others with it.

Interested in discussing this research or other custom research on questions you have? Reach out to us by email at jordan@bean.consulting or through our contact page.