Industry Research: Where People Buy Groceries

We offer custom industry research & competitive intelligence solutions. Below is a sampling of the types of data and insights we’re able to source, analyze, and deliver to clients.

How much thought do you put into where you shop for groceries?

Our guess is - not much. Most consumers pick a store that’s relatively close and meets their needs - lowest cost, best selection, product mix, or whatever else is important to them.

Looking at the bigger picture, the availability, variety, and density of grocery stores is quite different across market segments.

Consumers living in an area that’s more urban have higher store volume and variety.

In more rural areas, the options are more limited and sometimes the only option might be a non-traditional grocer like Dollar General.

For this research, we sourced and analyzed data from 21 brands representing 2,384 locations in North Carolina to develop a data-informed view on store density, brand segmentation, and industry behavior.

Industry Overview

People buy groceries in a variety of ways and places, including:

Traditional Grocery: Food as a primary offering.

Ex. Kroger, Trader Joes, Whole Foods

Big Box Retailer: Food as an important offering among many others.

Ex. Walmart, Costco, BJs, Target

Mixed Retailers: Food as one of many offerings or primarily packaged goods.

Ex. Dollar General, Convenience Stores

Online: Delivered from a traditional grocer or other means.

Ex. Amazon, Instacart (on behalf of retailers).

The grocery industry is highly fragmented across purchase channel, regions, and states.

Many might be surprised to learn that Walmart is by far the largest grocer in the country by market share, followed by Costco then Kroger, according to Axios & Chain Store Guide data.

These brands compete primarily on location, product selection, and market segment.

Location: People typically shop close to their home and work

Product Selection: The mix of private label and branded goods for sale

Market Segment: Households have different preferences for the product selection

Whole Foods will stock different products than Costco

By analyzing the markets and neighborhoods where brands choose to operate, we can infer the segment they’re targeting.

Further, we can understand patterns at scale in where grocery stores operate and what this says about the availability and accessibility of groceries across different areas.

For this research, we’ve isolated the information to the state of North Carolina. The state has urban and rural areas along with national and local brands, so in many ways it may act like other similar states.

The Competitive Landscape & Market Segmentation

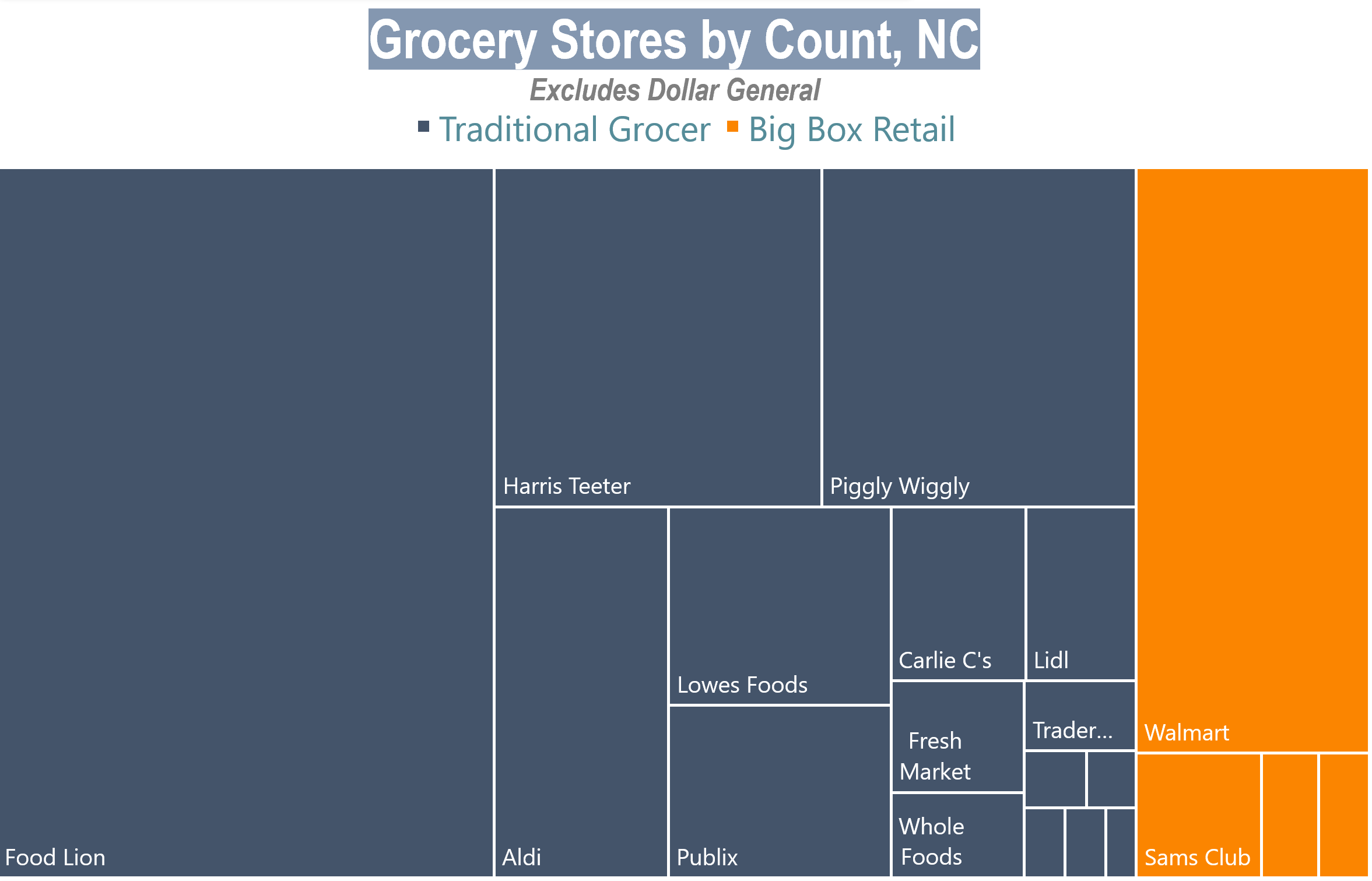

Depending on how exactly a grocer is defined and which brands are included the numbers here might vary, but we identified and pulled data on 20 grocery sellers in North Carolina representing 1,371 locations and 1 non-traditional grocer - Dollar General - with 1,013 locations.

In North Carolina, Food Lion has the most stores in the state followed by Walmart then Harris Teeter.

The outlier here - not on the visual - is Dollar General. They have nearly as many stores in North Carolina as the other grocers combined.

We’ve excluded them from some analyses since they’re not a traditional grocery chain, but at the same time, they are the primary grocery shopping location for many households. We’ll cover them in more detail later.

In North Carolina, the market breaks down primarily across 5 key segments (plus Dollar General) for multi-site chains:

Premium: Whole Foods, Sprouts, Fresh Market

Mass-Market: Publix, Harris Teeter, Trader Joe’s, Wegmans, Carlie C’s, Lowes Foods

Big Box: Walmart, BJ’s, Costco, Sam’s Club

Budget: Aldi, Lidl, Food Lion, Piggly Wiggly (yes, this is a real name)

Specialty / Local: Weaver St. Market, Earth Fare, Super G Mart

Other: Dollar General

We can largely see the differences between these segments with two primary metrics - urbanity (population density) and household income.

Premium brands are in areas with above average income and the highest population density. These brands target areas with large surrounding population, high income, and in or around major cities.

Moving down the table, we see population density and household income decrease. Brands that are tagged as Budget - and Dollar General - operate in areas that have lower household income and lower “urbanity”.

The primary difference between Budget and Dollar General is that Dollar General is in much more rural areas while Budget chains tend to be in lower income areas around more urban-suburban markets.

Market Analysis & Geographic Insights

Living near a major city means a consumer has more grocery store access and variety.

Adjusted for population size, counties with higher population and density tend to have higher grocery count, in addition to locations on the coast (which may benefit from higher seasonal demand in the summer).

More rural areas — like those on the outer borders of the state — generally have lower store availability.

This trend is not unique to grocers - urban areas generally have higher availability of retail stores, brands, and products.

Food, though, is a necessity, so lack of access looks different. Enter Dollar General into the picture.

The most rural counties are where brands like Dollar General become increasingly important.

There are 9 counties in North Carolina that have no grocery chains (among those in our research) and another 10 that have just 1. These counties are sparsely populated, rural, and largely at the boundaries of the state.

Dollar General operates 66 stores in these 19 counties compared to 10 total grocery chain locations. The brand provides critical access to food & groceries in places where traditional grocers don’t have the market size or density to operate profitably.

Dollar General has created a profitable brand and business in areas where few others can operate because of the limited market size and difficulty to reach logistically.

Let’s zoom in on a specific area in North Carolina.

In the first image, for context, the areas north and west of downtown Raleigh tend to be higher income households, per Census data, while the areas south and east tend to be lower.

Look for two points in the following image:

The overall variety and density of stores

Several marker colors (segments), closely spaced, accessible

To the South and East, the concentration of markers tends to be more Budget (green) and Big Box (beige); to the North and West are more Premium (red) and mass market (Blue)

For visual simplicity, we’ve excluded Local and Dollar General from the map.

As we move further outside Raleigh (in the top right of the next image), look for:

The volume and variety of grocery stores quickly drops off

More of the stores operating in this visual are in the Budget or Big Box category and there are wide chunks of land with no chains.

This isn’t a revolutionary finding - fewer stores operate where there are fewer people - but viewing how the brand segments locate and target different areas lets us see the spatial patterns and trends that emerge at scale.

Brands operate in areas that align with their target market. The grocery industry is no different.

Premium and specialty brands need certain levels of urbanity and income to operate. Mass market brands need a sufficient surrounding market size. Big Box and Budget have found the right formula to operate in more suburban-rural areas.

Final Thoughts

The grocery industry has many layers that make it interesting to research:

It’s a community necessity

It has high barriers to entry yet ample competition

There are value to premium offerings to cater to different market segments

As such, we can use the data on brands and locations to learn more about which brands target which customers and how these decisions impact the bigger picture of food availability.

More populated areas generally have more retail options across the board and grocery is no different.

It’s easier to find the market size and customers in urban areas and it’s more difficult to find the right unit economics & logistics as the area becomes more rural. This causes “food deserts” to form in rural areas, which is where retailers like Dollar General have stepped in to provide effective solutions in less populated areas.

Interested in this research or a custom research question you have? Check out our research and insights services, email us at jordan@bean.consulting, or contact us here.