Brand Research: How Equinox Fitness has Grown

How can brands grow revenue and into new geographies in highly competitive industries?

We looked at the fitness industry to answer this question. The industry has high competition and constantly changing trends. This requires businesses to be strategic and nimble to maintain growth and relevance.

Equinox is a mainstream brand that’s done just this — after 30 years in business, they remain growing, evolving, and relevant as a fitness & lifestyle brand. How?

We’ll highlight three reasons from our brand research that we’ll dive into in this article:

Well defined niche

Diversified service offering

Laser focused expansion strategy

Industry

Fitness is a notoriously challenging industry to succeed. Trends come and go. Competition is high. Consumer preferences change.

The universe of people who work out is large, but the available customers for any given gym is small.

Consider the following estimates:

In the US, there are ~260M people 18 or older (let’s call them “gym-eligible”)

~76% of adults report exercising monthly (physical activity at least once — let’s call them “exercisers”)

~25% of adults have a fitness center / health club membership (“membership paying”)

This means the addressable population of membership-paying gym goers in the US is ~64 million — about the combined population of California and Texas — out of the ~260M gym eligible population and ~200M exercisers.

Conversion from unpaid exercisers to membership-paying gym goers is likely low.

Between people that walk, run, or bike outdoors, use at-home gyms or apartment buildings with a gym, or use gyms in office buildings, many don’t have a need or desire for a paid membership.

This means that gyms are competing for their share of the ~64M+ membership-paying gym goers.

Competition for these memberships is high and fragmented, from Planet Fitness targeting value-conscious consumers to Barry’s (Bootcamp) targeting premium-seeking consumers.

Add in local studios and regional chains and the competition grows further.

To stand out requires a clear brand identity. Some studios focus on workout type — boxing, cycling, yoga — while others focus on target market — value, premium.

Where does Equinox fit in this market segmentation?

Equinox’s Market Positioning

Equinox competes for premium fitness customers.

Think of the Equinox customer as someone that goes to Blue Bottle Coffee in the morning, sweetgreen for lunch, and picks up groceries from Whole Foods for dinner — white collar professionals with high-earning urban jobs that value health & wellness.

Equinox is unique from other fitness brands in that their range of offerings extends beyond just their branded physical spaces.

Through acquisitions and new ventures, Equinox has expanded by both serving multiple segments of the fitness industry through distinct brands while also looking at other ways to serve their core luxury customer.

Want a typical gym experience at a value price? They have that. A cycling studio? They have that too. A top-of-the-line amenities rich experience? Yup, that too.

Below is a sampling of the businesses and brands that sit under the Equinox umbrella.

Diversified Fitness Offerings

Premium Equinox experience

Owns SoulCycle (~100 upscale cycling studios)

Has a digital streaming platform (Equinox+)

Sells at-home bikes through SoulCycle

Owns general fitness brand (Blink Fitness, 105 locations)

Has separate running & yoga brands

Non-Fitness Offerings Overlapping with Target Market

A brand portfolio that includes development of hotels, residential, spas, and office + coworking (in addition to Fitness Clubs — Hotels seem to be the only active non-fitness development right now)

Tested a luxury travel-workout experience — Equinox Explore

Launched Equinox Media to manage their digital assets

Their fitness segment is both physical & digital while covering the value (Blink) to premium (Equinox) segments plus offerings for the at-home exerciser. The non-fitness offerings are ways to extend their core brand and grow with current customers.

The Equinox brand is positioned as a luxury fitness provider. They differentiate through their exclusivity, member benefits & amenities, and location strategy.

The Equinox company is diversified, adaptable, and well positioned to meet the evolving needs of the industry and their target customer.

Market Expansion Strategy

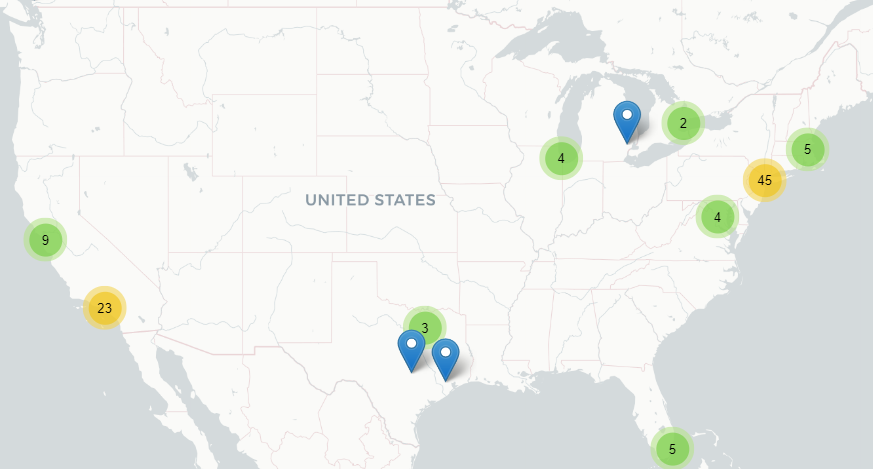

Market map for Equinox locations; Excludes most international locations.

Equinox’s market expansion strategy has been narrow and focused in upscale areas of large, wealthy metros.

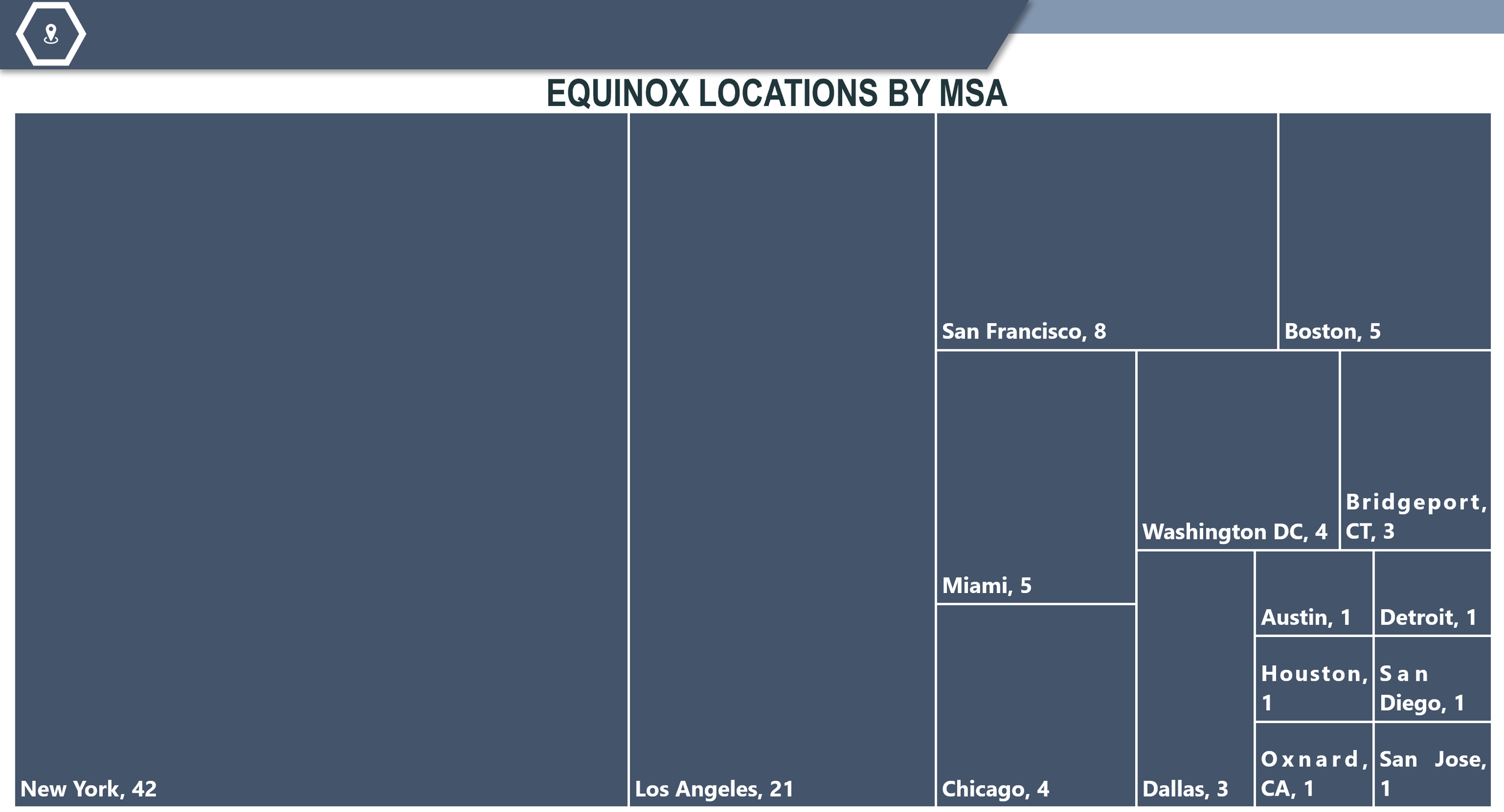

The company operates 101 locations across 15 metros in the US (plus 5 locations in Canada and the UK). Though market count looks high, 60% of locations are in just two markets — New York (41) and Los Angeles (21).

NOTE: Only the first name of the MSA is shown for brevity; Excludes international locations.

Location growth has been consistent since the first gym in 1993. At least one location was added in all but a handful of years and the most prominent growth was the 10-year span between 2008 and 2018 where location count more than doubled.

The brand started in New York City and has expanded into new markets, all while continuing to build its presence in NYC.

~10 years into its existence is when the brand started to meaningfully expand outside its home market. Between 2000–2009, Equinox entered 11 new markets.

Between 2010 and 2019, Equinox opened in just 5 new markets, but continued building density in its core markets.

8 of the 9 markets that Equinox entered between 2000–2009 had at least one additional location added between 2010–2019

The brand has followed a “land and expand” method by picking their key markets, establishing a presence, and then building density in those markets.

These locations are in mixed use areas — white collar professionals and upscale residential — or directly in high-end spaces with their target customer (hotels, office buildings).

This land-and-expand strategy is evidenced by their footprint in New York City. Several locations are just a handful of blocks apart as the brand has continued to build density in the market.

Many brands think of cannibalization by proximity — how close one location is to another — but more important is understanding market capacity.

New York City has the capacity to successfully locate multiple locations in close proximity to another because the target market — high earning white collar professionals — are so prominent.

This strategy won’t work in almost any other market in the US, but that’s the importance of understanding the demand on a market-by-market level for a product or service.

Equinox’s market strategy can be summed up as finding the target audience and making it as easy as possible for members to reach them, even at the expense of a degree of cannibalization.

To serve their target market requires this level of convenience. A premium price point requires a premium experience, which is everything from where the club is located to the amenities offered once inside the space.

Final Thoughts

Equinox has persevered in a challenging industry through their ability to find product-market fit with their target audience, expand in current and new segments, and develop an effective market plan to reach their target customer.

Based on their past activity, it stands to reason that upcoming growth will likely look like:

More locations in current markets

New offerings for their core target customer

Continued diversification of fitness offerings through subsidiaries to reach different market segments

This industry and market requires constant reinvention, a laser focus on the segment that a company wants to serve, and execution in delivering the experience that the customer expects.

Equinox is among the few brands that has and continues to be a dominant brand in the industry because of their ability to do the above. Continued success will mean more changes and evolution ahead, the same situation that many other industries & brands face today.

We provide data-driven, analytics-informed research on brands, industries, and topics geared toward growing companies. Interested in this research or other topics? Reach out to us to learn more through out website or by email at jordan@bean.consulting.